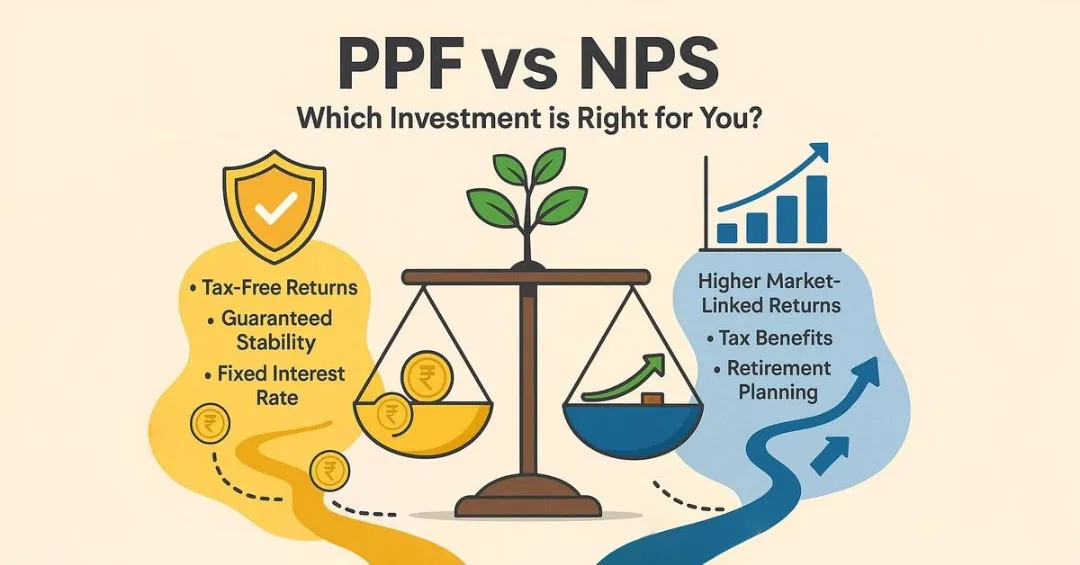

When planning for your financial future, it’s important to understand the various investment options available. Two of the most popular government-backed investment schemes in India are the Public Provident Fund (PPF) and the National Pension Scheme (NPS). Both are long-term investment options, but each has distinct features, benefits, and limitations. In this article, we’ll provide an in-depth comparison of PPF and NPS to help you understand their key differences, advantages, and disadvantages, allowing you to choose the right option based on your personal financial goals.

Understanding PPF and NPS

What is PPF?

The Public Provident Fund (PPF) is a popular savings scheme offered by the Government of India that is primarily designed to help individuals save for their retirement or other long-term financial goals. The scheme offers a fixed interest rate and comes with various tax benefits under Section 80C of the Income Tax Act.

- Tenure: Fixed at 15 years (with the option to extend it in blocks of 5 years).

- Risk: No risk, as PPF is a government-backed scheme offering guaranteed returns.

- Interest: The interest rate is revised quarterly by the government (typically 7% to 8% annually).

- Taxation: Tax-free returns and the corpus at maturity.

What is NPS?

The National Pension Scheme (NPS) is a voluntary, long-term investment option primarily aimed at securing your retirement. It is structured to encourage individuals to invest regularly in a mix of equity, government bonds, and corporate securities. NPS is managed by the Pension Fund Regulatory and Development Authority (PFRDA).

- Tenure: Flexible, allowing contributions until the age of 70, and the pension can be accessed from the age of 60.

- Risk: Higher risk due to exposure to equity and market-linked instruments.

- Returns: Variable returns based on the performance of the chosen fund.

- Taxation: Tax benefits under Section 80C and 80CCD(1B), but partial withdrawal is taxable.

Key Differences Between PPF and NPS

1. Investment Tenure and Flexibility

- PPF: The 15-year tenure is a key feature of PPF. You can extend the tenure in blocks of 5 years after the initial period. While you can’t withdraw the entire corpus before maturity, partial withdrawals are allowed after the 6th year.

- NPS: NPS is more flexible with no fixed investment period. You can contribute until you turn 70, and the pension is accessible only after you reach 60. However, you must use at least 40% of your corpus to purchase an annuity, which is a taxable income.

2. Returns: Fixed vs. Market-Linked

- PPF: The returns from PPF are guaranteed, as they are set by the government. The interest rate is fixed (currently around 7-8% per annum), ensuring stability and predictability over time. However, the returns may not keep up with inflation in the long term.

- NPS: Unlike PPF, NPS offers market-linked returns. You can choose between equity, corporate bonds, and government securities, depending on your risk tolerance. While equity-based funds may offer returns of 8-12% annually, they come with the risk of market volatility. The overall return will depend on your asset allocation and the market performance.

3. Tax Benefits

- PPF: PPF offers substantial tax-saving benefits under Section 80C, where contributions up to ₹1.5 lakh per year are deductible. Additionally, the interest earned and the maturity amount are exempt from tax, making PPF a fully tax-free investment.

- NPS: NPS also offers tax benefits under Section 80C (up to ₹1.5 lakh) but offers an additional benefit under Section 80CCD(1B), where you can invest an additional ₹50,000 in NPS to get extra tax deductions. However, the corpus generated through NPS is partially taxable at the time of withdrawal (except for the portion used to buy an annuity). This makes NPS a tax-efficient product for retirement planning.

4. Liquidity

- PPF: Liquidity in PPF is limited. While you cannot withdraw the entire amount before the 15-year term ends, you can make partial withdrawals after the 6th year for certain financial needs. However, premature closure is only allowed under specific circumstances, such as serious illness or higher education.

- NPS: NPS is primarily designed as a retirement tool with restricted access to funds until the age of 60. You can make partial withdrawals in certain cases, such as for buying a home, medical treatment, or higher education. But, it’s important to note that NPS isn’t meant to be a liquid investment, and you are encouraged to keep contributing until retirement.

5. Risk Factor

- PPF: PPF is risk-free, as it is backed by the Government of India. Your returns are predictable and unaffected by market fluctuations. This makes PPF a safe haven for conservative investors looking for guaranteed returns.

- NPS: NPS involves market risk due to its investment in equity and other market-linked instruments. While the return potential is higher, the risk is also higher. If you are comfortable with taking on some risk for higher returns, NPS might be a better option. However, for those who are risk-averse, PPF remains a safer alternative.

6. Exit Strategy: Annuity vs. Lump Sum

- PPF: At maturity, PPF offers a lump sum withdrawal. You can either withdraw the entire corpus or extend the scheme. There’s no compulsion to convert it into an annuity.

- NPS: NPS requires that at least 40% of the corpus be used to buy an annuity. The remaining 60% can be withdrawn as a lump sum (taxable). The annuity provides you with a steady income stream post-retirement but is subject to taxation.

Which Investment Option Suits You Better?

The choice between PPF and NPS depends on your investment objectives, risk appetite, and time horizon. Here’s a quick breakdown:

- Choose PPF if:

- You prefer guaranteed returns with no exposure to market risk.

- You want to invest in a safe, low-risk instrument for long-term financial goals.

- You’re looking for tax-free returns and a disciplined savings plan.

- You require more liquidity or early access to your funds, as PPF allows partial withdrawals after 6 years.

- Choose NPS if:

- You are primarily focused on building a retirement corpus.

- You’re willing to accept some market risk in exchange for higher returns.

- You want to take advantage of additional tax benefits under Section 80CCD(1B).

- You prefer an annuity post-retirement to ensure a steady income stream.

Example of Returns: PPF vs NPS

PPF Example:

- Monthly Contribution: ₹10,000

- Interest Rate: 7.5%

- Investment Period: 15 years

With these assumptions, your PPF corpus could grow to approximately ₹39.1 lakhs at the end of 15 years, with tax-free returns.

NPS Example:

- Monthly Contribution: ₹10,000

- Equity Allocation: 50%

- Debt Allocation: 50%

- Return on Equity: 12% p.a.

- Return on Debt: 7% p.a.

- Investment Period: 15 years

In this case, your NPS corpus could grow to around ₹41.25 lakhs at the end of 15 years, though the returns are taxable upon withdrawal. For detailed projections, you can use the NPS Calculator to estimate your potential returns.

Conclusion

Both PPF and NPS are excellent investment options, but they serve different financial goals. PPF is ideal for conservative investors looking for guaranteed returns, tax savings, and long-term growth without the risk of market fluctuations. On the other hand, NPS is a better fit for individuals focused on retirement planning who are comfortable with some market risk and want higher return potential along with additional tax benefits.

When deciding between PPF and NPS, it’s essential to align your choice with your financial goals and risk profile. Use the right calculators to compare the returns and make an informed decision. Remember, both are solid tools for securing your future, but understanding the unique features of each will help you make the right choice for your needs. You can also explore the PPF Calculator for a more accurate assessment of your PPF returns.