Dreaming of building wealth over time but not sure where to start? Systematic Investment Plans, popularly known as SIPs, offer a disciplined and accessible way to enter the world of investments, particularly in mutual funds. This guide will walk you through everything you need to know about SIPs, from understanding what they are and their benefits to a step-by-step process on how to start investing and common mistakes to avoid. Let’s unlock the potential of SIPs for your financial growth.

What is a Systematic Investment Plan (SIP)?

A Systematic Investment Plan (SIP) is a method of investing a fixed sum of money at regular intervals (typically monthly or quarterly) into a chosen mutual fund scheme. Instead of investing a large lump sum at one go, SIPs allow you to invest smaller amounts consistently over time. This approach makes investing more manageable and helps cultivate a habit of disciplined saving.

Think of it like a recurring deposit for mutual funds, but with the potential for market-linked returns. You decide the amount, the frequency, and the mutual fund scheme you want to invest in. The predetermined amount is then automatically debited from your bank account and invested in the chosen scheme.

Why Invest Through SIPs? The Benefits Unpacked

SIPs have become a popular investment route for many, and for good reason. They offer several advantages, particularly for retail investors seeking to accumulate long-term wealth.

- Power of Compounding: One of the most significant benefits of SIPs is that they allow you to harness the power of compounding. Compounding means your investment earnings start generating their own earnings. When you invest regularly through SIPs over a long period, even small amounts can grow into a substantial corpus.

- Rupee Cost Averaging: SIPs help mitigate the risk of market timing. Since you invest a fixed amount regularly, you buy more units when the market prices are low and fewer units when prices are high. This averages out your cost of purchase per unit over time, a concept known as rupee-cost averaging. This strategy can help smooth out the impact of market volatility.

- Disciplined Investing: SIPs instill a habit of regular and disciplined saving and investing. By automating your investments, you are less likely to miss contributions or make impulsive decisions based on market sentiment.

- Affordability & Flexibility: You don’t need a large sum to start investing via SIPs. Many mutual funds allow you to start a Systematic Investment Plan (SIP) with amounts as low as ₹500 or ₹1000 per month. You can also choose the investment frequency (monthly or quarterly) and often have the flexibility to increase your SIP amount (sometimes referred to as a step-up SIP) as your income grows.

- Convenience: Setting up an SIP is generally a hassle-free process. Once the initial setup and Know Your Customer (KYC) formalities are complete, the investment process is fully automated. Many transactions can be done online through apps or websites.

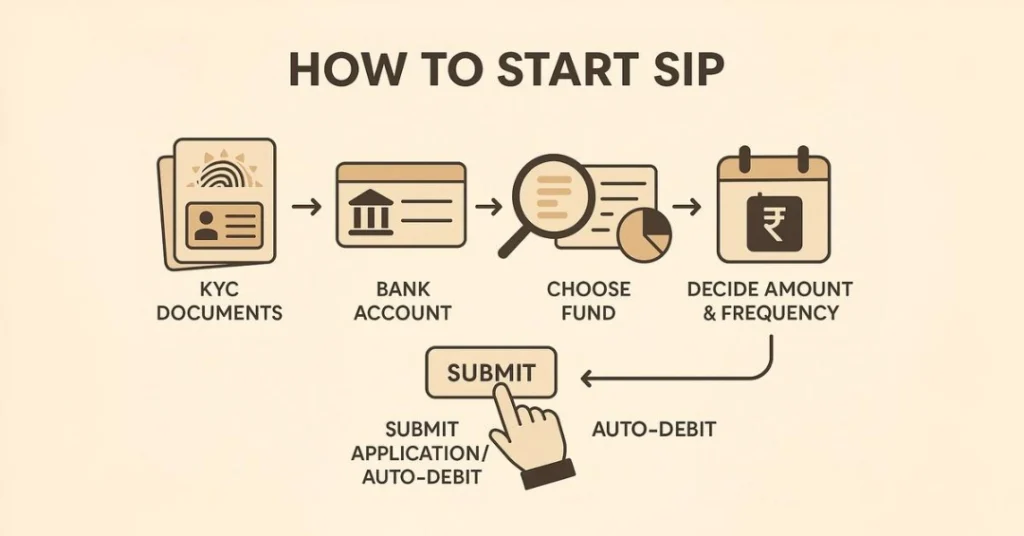

How to Start an SIP – A Step-by-Step Guide

Starting an SIP is a straightforward process. Here’s a general guide:

- Complete Your KYC (Know Your Customer): As per regulatory guidelines (e.g., SEBI regulations), being KYC compliant is mandatory to invest in mutual funds. This involves submitting identity proof (such as a PAN card or Aadhaar card), address proof, and a photograph. This is usually a one-time process. Many fund houses and platforms offer eKYC facilities.

- Have a Bank Account: You will need an active bank account to set up the SIP, as the investment amounts will be auto-debited from this account. You’ll need to provide your bank account details (account number, IFSC code) and often a cancelled cheque. For Non-Resident Indians (NRIs), investments are typically facilitated through NRE (Non-Resident External) or NRO (Non-Resident Ordinary) accounts.

- Choose a Mutual Fund Scheme: This is a crucial step. Research and select a mutual fund scheme that aligns with your financial goals (e.g., retirement, your child’s education, wealth creation), risk tolerance, and investment horizon. Mutual funds can be equity funds (investing in stocks, higher risk, potential for higher returns), debt funds (investing in bonds, lower risk), or hybrid funds (a mix of both). Consider factors such as the fund manager’s track record, the fund’s past performance (though not the only factor), portfolio quality, and investment strategy.

- Decide on the Investment Amount and Frequency: Determine how much you want to invest regularly (e.g., ₹1,000 or ₹5,000 per month) and the frequency (typically monthly or quarterly). Choose an amount that you can comfortably invest without straining your finances. Our Mutual Fund Calculator can help you project how different amounts might grow.

- Fill and Submit the Application Form and SIP Mandate: You’ll need to complete the mutual fund application form and an SIP auto-debit mandate form (ECS mandate). This form authorises your bank to debit the SIP amount from your account on the chosen date and transfer it to the Asset Management Company (AMC). This can often be done online through the AMC’s website, registrar and transfer agents (RTAs), or various investment platforms and apps.

Key Things to Consider When Investing in SIPs

While SIPs simplify investing, a few considerations can help you make the most of them:

- Align with Financial Goals: Begin a Systematic Investment Plan (SIP) with a clear financial objective in mind (e.g., retirement, purchasing a home, or your child’s education). This helps determine the investment amount, tenure, and type of fund.

- Understand Your Risk Appetite: Different mutual funds carry different levels of risk. Equity funds are generally riskier than debt funds but offer higher potential returns over the long term. Select funds that align with your ability to withstand market fluctuations.

- Fund Selection is Key: Don’t choose funds based solely on past performance or tips. Consider the fund’s investment objective, its performance consistency across various market cycles, the fund manager’s experience, and the quality of its underlying portfolio.

- Expense Ratio: Mutual funds charge an annual fee, called the expense ratio, to manage your investments. A higher expense ratio can reduce your net returns, especially over the long term. Compare expense ratios of similar funds.

- Review Periodically: While SIPs are designed for long-term investing, it’s a good idea to review your investments at least once or twice a year. This helps ensure they are still aligned with your goals and allows you to make adjustments if market conditions or your personal circumstances change significantly.

- Long-Term Horizon: SIPs, especially in equity mutual funds, tend to deliver better results over the long term (e.g., 5, 10, or more years). This allows time for compounding and for rupee-cost averaging to work effectively through market cycles.

Common Mistakes to Avoid with SIPs

Being aware of common pitfalls can help you stay on track with your SIP investments:

- Stopping SIPs During Market Corrections: Many investors panic and stop their Systematic Investment Plans (SIPs) when the market falls. This is often counterproductive, as market corrections are opportunities to buy more units at lower prices, potentially boosting long-term returns.

- Investing Without a Clear Plan or Goal: Starting a Systematic Investment Plan (SIP) without a specific financial objective can lead to premature withdrawals or insufficient investment returns.

- Choosing Funds Based Only on Past Performance: While historical returns are a factor, they don’t guarantee future results. A holistic approach to fund selection is necessary.

- Ignoring the Expense Ratio: A high expense ratio can eat into your returns over time.

- Not Reviewing Investments Periodically: Financial goals and market conditions are constantly evolving. Failing to review your SIPs can lead to your portfolio becoming misaligned with your objectives.

- Expecting Quick Returns: SIPs in equity funds are meant for long-term wealth creation. Expecting very high returns in a short period can lead to disappointment.

Taxation of SIP Investments

The taxation of gains from SIP investments in mutual funds depends on the type of mutual fund (equity-oriented or debt-oriented) and the holding period of the units.

- Equity Mutual Funds:

- Short-Term Capital Gains (STCG): If units are sold within one year of purchase, gains are considered STCG and are typically taxed at a rate like 15% or 20% (plus applicable cess/surcharges). (Note: Specific rates can vary based on prevailing tax laws.)

- Long-Term Capital Gains (LTCG): If units are held for more than one year, gains are LTCG. LTCG above a certain threshold (e.g., ₹1 lakh or ₹1.25 lakh annually) may be taxed at a rate like 10% or 12.5% without indexation benefits.

- Debt Mutual Funds:

- Gains from debt funds are generally added to your income and taxed at your applicable income tax slab rate, irrespective of the holding period for investments made after certain dates (e.g., April 1, 2023, in some contexts). For older investments, STCG (held < 3 years) was taxed at slab rates, and LTCG (held > 3 years) was taxed at 20% with indexation.

- Equity Linked Savings Schemes (ELSS): Investments in ELSS mutual funds (Decide on the Investment Amount and Frequencywhich have a 3-year lock-in) qualify for tax deduction under Section 80C of the Income Tax Act, up to ₹1.5 lakhs. The gains are taxed like other equity funds.

Disclaimer: Tax laws are subject to change. It’s always advisable to consult with a tax advisor for personalised advice based on the latest regulations.

Start Your SIP Journey Today!

Systematic Investment Plans offer a powerful yet simple way to build wealth over the long term. By promoting disciplined investing, leveraging the benefits of rupee-cost averaging and compounding, and providing accessibility, SIPs have empowered millions to participate in the growth potential of mutual funds.

Whether you are planning for retirement, your child’s education, buying a home, or any other long-term financial goal, starting a Systematic Investment Plan (SIP) can be a prudent step. Remember to align your investments with your goals, understand the risks involved, and stay committed to your plan. Explore our range of financial calculators to help you plan effectively. Your journey to financial well-being can begin with that first smart SIP.

Frequently Asked Questions (FAQs)

What is the minimum amount to start an SIP?

Many mutual funds allow you to start an SIP with as little as ₹500 or ₹1,000 per month.

Can I stop my Systematic Investment Plan (SIP) if I face financial difficulties?

Yes, you can usually pause or stop your SIP. However, it’s generally advisable to continue, especially during market downturns, to benefit from rupee-cost averaging. If you stop, your existing invested units remain in your account.

How do I select the right mutual fund for my Systematic Investment Plan (SIP)?

Consider your financial goals, risk tolerance, investment horizon, the fund’s past performance (but not solely), expense ratio, and the fund manager’s expertise. It’s often helpful to consult a financial advisor.

Can I increase my SIP amount later?

Yes, many Asset Management Companies (AMCs) offer a “Step-up SIP” facility that allows you to increase your Systematic Investment Plan (SIP) amount at predefined intervals (e.g., annually). Alternatively, you can start a new SIP for the additional amount in the same or a different fund.

Are SIP returns guaranteed?

No, SIPs in mutual funds are subject to market risks, and returns are not guaranteed. The value of your investments can fluctuate based on market performance. However, over the long term, equity SIPs have historically shown the potential to provide good returns. You can use our SIP Calculator to see potential return projections based on different scenarios.

Is KYC mandatory for SIP investments?

Yes, completing your Know Your Customer (KYC) formalities is mandatory before you can invest in mutual funds through a Systematic Investment Plan (SIP).