When I first began my financial planning journey, the National Pension System (NPS) seemed like just another option among many. However, as I delved deeper, I realized it’s one of the most powerful and flexible retirement savings schemes designed by the Government of India. It offers a unique combination of market-linked growth, significant tax advantages, and disciplined saving that is hard to match.

This guide will help you understand the ins and outs of NPS for the Financial Year 2025-26. We’ll cover who can invest, how contributions work, the crucial tax benefits that can save you up to ₹2 lakhs, and the all-important withdrawal rules.

What is the National Pension System (NPS)?

At its core, NPS is a voluntary, defined-contribution retirement savings scheme regulated by the Pension Fund Regulatory and Development Authority (PFRDA). During your working years, you contribute to your NPS account. These funds are then invested by professional Pension Fund Managers (PFMs) into a mix of equities, corporate bonds, and government securities, based on your preference. The final pension amount you receive depends on your total contributions and the investment growth over time.

Who Can Invest in NPS? Eligibility & Account Types

Eligibility: NPS is open to almost every Indian citizen, including:

- Resident or Non-Resident Indians (NRIs) between the ages of 18 and 70 years.

- Overseas Citizens of India (OCIs) are also eligible.

Account Types: NPS operates with two distinct accounts, and understanding the difference is key:

- Tier I Account: This is your primary retirement account. It is mandatory for NPS subscribers and comes with significant tax benefits. However, withdrawals are restricted until retirement to ensure the funds are used for their intended purpose.

- Tier II Account: This is a completely voluntary savings account. You can only open a Tier II account if you have an active Tier I account. It offers great flexibility, allowing you to withdraw funds at any time. The trade-off is that contributions to a Tier II account generally do not offer tax benefits (with some exceptions for Central Government employees).

NPS Contributions: Building Your Retirement Fund

- Minimum Contributions:

- Tier I: A minimum of ₹500 is needed to open the account, with at least one contribution of ₹500 required each year.

- Tier II: Requires a minimum of ₹1,000 to open, with subsequent contributions of at least ₹250. There is no mandatory annual contribution for Tier II.

- Maximum Contributions: There is no upper limit on how much you can contribute to your NPS account annually. However, the tax benefits are capped at specific limits, which we’ll discuss next.

- Contribution Modes: You can contribute online via eNPS, through designated Points of Presence (PoPs) like banks, or using the newly integrated Bharat Bill Payment System (BBPS) for added convenience.

NPS Investment Choices: Active vs. Auto Choice

One of the best features of NPS is its flexibility. You get to decide how your money is invested.

- Active Choice: If you are comfortable managing your investments, you can actively decide your asset allocation across four classes:

- Equity (E): Stocks, with a maximum allocation of 75% (this limit reduces after age 50).

- Corporate Bonds (C): Debt securities from companies.

- Government Securities (G): Central and state government bonds.

- Alternative Investment Funds (A): REITs, InvITs, etc., with a maximum allocation of 5%.

- Auto Choice (Lifecycle Funds): This is a fantastic “set it and forget it” option. It automatically adjusts your investment mix based on your age, becoming more conservative (shifting from equity to debt) as you near retirement. There are several lifecycle fund options like Aggressive (LC75), Moderate (LC50), and Conservative (LC25) to match your risk appetite.

You can change your investment choice and your Pension Fund Manager (PFM) once per financial year.

NPS Tax Benefits: The Triple Advantage (FY 2025-26)

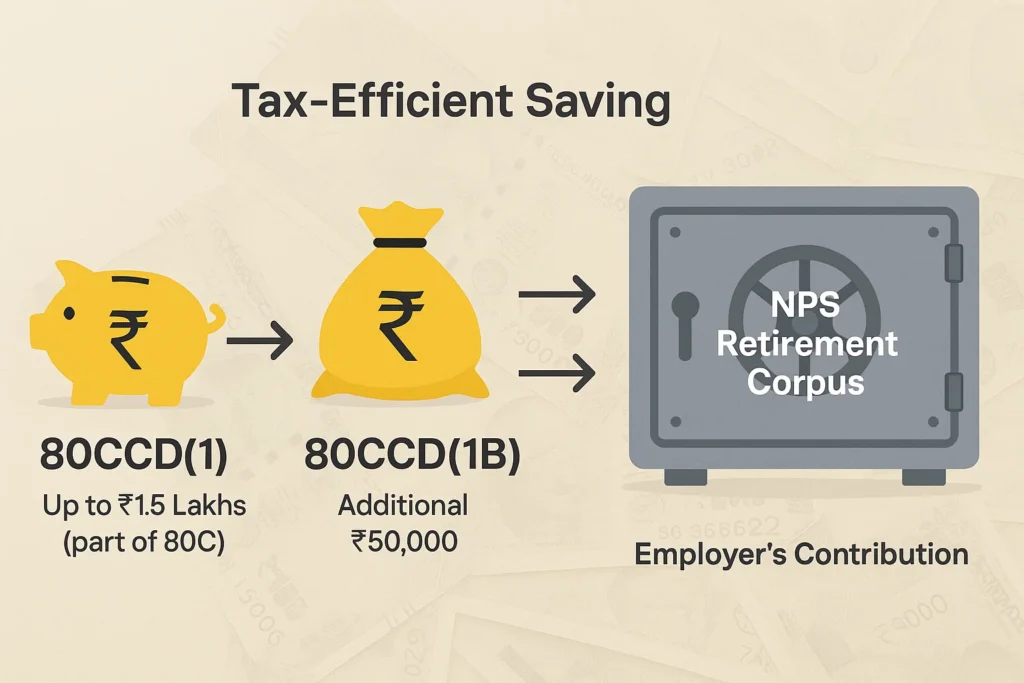

This is where NPS truly shines, especially under the old tax regime. It offers a unique three-pronged tax benefit that can total over ₹2 lakhs.

- Section 80CCD(1): Your own contribution is tax-deductible up to 10% of your salary (Basic + DA), or 20% of gross income for the self-employed. This falls within the overall ₹1.5 lakh limit of Section 80C.

- Section 80CCD(1B): This is the game-changer. You get an exclusive additional deduction of up to ₹50,000 for your NPS contribution. This is over and above the ₹1.5 lakh limit, effectively increasing your total deduction potential to ₹2 lakhs.

- Section 80CCD(2): Your employer’s contribution to your NPS account is also deductible.

- For Central & State Government employees: Up to 14% of salary (Basic + DA).

- For private-sector employees: Up to 10% of salary (Basic + DA). This deduction is in addition to the limits under 80C and 80CCD(1B), making corporate NPS highly attractive.

Navigating NPS Withdrawals: Rules for Every Stage

Understanding the withdrawal rules is crucial. They are designed to preserve your retirement corpus.

Withdrawal on Superannuation (at Age 60):

- Lump Sum: You can withdraw up to 60% of your total corpus as a tax-free lump sum.

- Annuity Purchase: You must use a minimum of 40% of the corpus to buy an annuity plan, which provides you with a regular monthly pension. This pension income is taxable as per your slab.

- Full Withdrawal for Small Corpus: If your total corpus is ₹5 lakh or less, you can withdraw the entire amount tax-free without buying an annuity.

- New Feature – Systematic Lump Sum Withdrawal (SLW): PFRDA now allows you to withdraw your 60% lump sum portion in a phased manner (monthly, quarterly, half-yearly, or annually) until you turn 75, providing a regular income stream.

Premature Exit (Before Age 60):

- Eligibility: You can exit prematurely after being in NPS for at least 5 years.

- Lump Sum: You can only withdraw up to 20% of the corpus.

- Annuity Purchase: A mandatory 80% of the corpus must be used to purchase an annuity.

- Full Withdrawal for Small Corpus: If the total corpus is ₹2.5 lakh or less, you can withdraw the entire amount.

Partial Withdrawal from Tier I Account:

- Eligibility: Allowed after a minimum of 3 years in the scheme.

- Limit: You can withdraw up to 25% of your own contributions (not the total corpus).

- Frequency: A maximum of three partial withdrawals are allowed during the entire tenure for specific reasons like children’s higher education or marriage, house purchase, or treatment of critical illnesses. These withdrawals are tax-free.

Withdrawal on Death of Subscriber: The entire accumulated pension wealth (100%) is paid to the nominee or legal heir.

Recent NPS Updates & Reforms (2024-2025)

PFRDA continuously evolves NPS to make it more user-friendly:

- NPS Vatsalya: A new scheme launched on September 18, 2024, allowing parents to open an NPS account for their minor children (up to age 18) to promote early savings.

- Integration with Bharat Bill Payment System (BBPS): As per a PFRDA circular on August 28, 2024, you can now make NPS contributions easily through UPI apps like BHIM and PhonePe via the BBPS platform.

- Systematic Lump Sum Withdrawal (SLW): Introduced via a PFRDA circular on October 27, 2023, this feature provides greater flexibility for managing lump sum withdrawals post-retirement.

How to Open an NPS Account

Opening an NPS account is straightforward:

- Online (eNPS): The quickest way is through the eNPS portal using your Aadhaar or PAN and bank details.

- Offline (Through PoPs): You can visit a Point of Presence (PoP)—which includes most major banks and financial institutions—and fill out the registration form.

Secure Your Retirement with NPS

The National Pension System is a robust, flexible, and highly tax-efficient platform for building your retirement savings. Its diverse investment options, significant tax advantages, and evolving, user-friendly features make it an invaluable tool for anyone serious about securing their financial future.

Disclaimer

The information provided in this article is for educational purposes only and should not be considered as financial advice. All readers are advised to consult with a qualified financial professional before making any investment decisions.

Frequently Asked Questions (FAQs)

What is the main difference between NPS Tier I and Tier II accounts?

Tier I is the mandatory retirement account with tax benefits and withdrawal restrictions. Tier II is a voluntary, flexible savings account with no lock-in period but generally no tax benefits.

What is the maximum tax benefit I can get from NPS?

You can claim up to ₹1.5 lakh under Sec 80CCD(1) (within the 80C limit), an additional ₹50,000 under Sec 80CCD(1B), and a deduction for your employer’s contribution under Sec 80CCD(2).

Can I withdraw 100% of my NPS corpus at retirement?

Yes, if your total corpus is ₹5 lakh or less at age 60, you can withdraw the entire amount tax-free. Otherwise, a minimum of 40% must be used to buy an annuity.

How many times can I make a partial withdrawal from my NPS Tier I account?

You can make a maximum of three partial withdrawals during your entire subscription for specified reasons, after completing 3 years in the scheme.

Is the annuity income from NPS taxable?

Yes, the regular pension (annuity) you receive is added to your income and taxed according to your income tax slab.

What is NPS Vatsalya?

NPS Vatsalya is a recently launched scheme that allows parents or guardians to open an NPS account for their minor children (under 18) to start their retirement planning early.