As the financial year draws to a close, the task of calculating and filing income tax returns looms large for many. Understanding your tax liability can be complex, with various income sources, deductions, and changing tax regimes. Thankfully, an Income Tax Calculator is a powerful tool that can demystify this process for the Financial Year 2024-25 (Assessment Year 2025-26). This guide will help you understand how to use such a calculator effectively to plan your taxes and ensure accurate filings.

Why Use an Income Tax Calculator?

Before diving into the ‘how-to’, let’s understand the benefits:

- Accuracy: Calculators minimise manual errors that can occur during complex tax computations.

- Time-Saving: Get instant calculations instead of spending hours with spreadsheets.

- Regime Comparison: Easily compare your tax liability under the old and new tax regimes to determine which one is most beneficial.

- Tax Planning: Understand your potential tax liability in advance, enabling more informed financial planning and the identification of tax-saving opportunities.

- User-Friendly: Designed for ease of use, even if you’re not a tax expert.

Understanding Tax Regimes: Old vs. New (FY 2024-25)

For FY 2024-25 (AY 2025-26), taxpayers in India can choose between two tax regimes:

- Old Tax Regime: This regime enables you to claim various deductions and exemptions, including those under Section 80C (such as EPF, PPF, and ELSS), Section 80D (for health insurance), HRA exemption, and home loan benefits, among others.

- New Tax Regime (Default): This regime offers lower, concessional tax rates but disallows most common deductions and exemptions. For FY 2024-25, the new tax regime is the default option. If you don’t explicitly opt for the old regime, your tax will be calculated as per the new regime.

An income tax calculator is invaluable for comparing your liability under both regimes.

Income Tax Slabs for FY 2024-25 (AY 2025-26)

Knowing the applicable tax slabs is crucial.

New Tax Regime Slabs (FY 2024-25 / AY 2025-26):

This regime has the same slabs for all individuals, irrespective of age.

| Income Slab (₹) | Tax Rate |

| Up to 3,00,000 | Nil |

| 3,00,001 to 7,00,000 | 5% |

| 7,00,001 to 10,00,000 | 10% |

| 10,00,001 to 12,00,000 | 15% |

| 12,00,001 to 15,00,000 | 20% |

| Above 15,00,000 | 30% |

Note: A tax rebate under Section 87A makes income up to ₹7 lakhs effectively tax-free under the new regime. A standard deduction of ₹75,000 is available for salaried individuals and pensioners under the new regime for the financial year 2024-25.

Old Tax Regime Slabs (FY 2024-25 / AY 2025-26):

Slabs vary by age.

- Individuals below 60 years & NRIs:

| Income Slab (₹) | Tax Rate |

| Up to 2,50,000 | Nil |

| 2,50,001 to 5,00,000 | 5% |

| 5,00,001 to 10,00,000 | 20% |

| Above 10,00,000 | 30% |

- Senior Citizens (60 to less than 80 years):

| Income Slab (₹) | Tax Rate |

| Up to 3,00,000 | Nil |

| 3,00,001 to 5,00,000 | 5% |

| 5,00,001 to 10,00,000 | 20% |

| Above 10,00,000 | 30% |

- Super Senior Citizens (80 years and above):

| Income Slab (₹) | Tax Rate |

| Up to 5,00,000 | Nil |

| 5,00,001 to 10,00,000 | 20% |

| Above 10,00,000 | 30% |

Note: A tax rebate under Section 87A makes income up to ₹5 lakhs effectively tax-free under the old regime. A standard deduction of ₹50,000 is available for salaried individuals and pensioners under the old regime.

A Health and Education Cess of 4% is applicable on the income tax amount under both regimes.

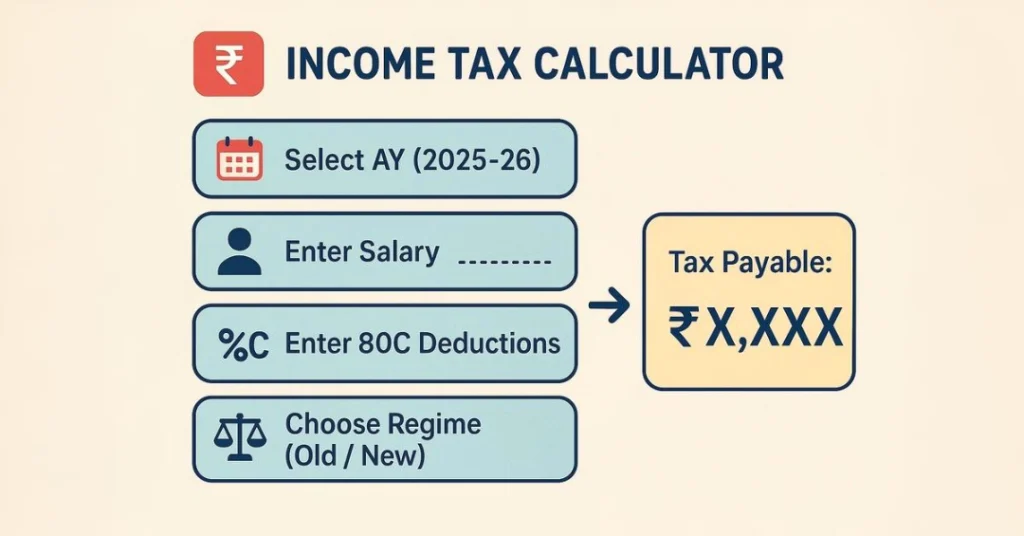

How to Use an Income Tax Calculator: A Step-by-Step Guide

Using an income tax calculator is typically a simple process:

- Select Assessment Year (AY): Ensure you choose AY 2025-26 for income earned in FY 2024-25.

- Enter Your Age/Taxpayer Category: This helps apply the correct slab rates, especially under the old regime.

- Input Your Income Details:

- Gross Salary Income: Your total salary before any deductions.

- Income from House Property: Rental income or loss from house property.

- Capital Gains: Profits from the sale of assets like property, shares, or mutual funds. A capital gains calculator can help determine this figure.

- Income from Business/Profession: If applicable.

- Income from Other Sources: Interest from savings accounts, fixed deposits (use an FD calculator to see interest), dividends, etc.

- Enter Deductions (Primarily for Old Regime):

- Section 80C: Investments like EPF (check with EPF Calculator), PPF (PPF Calculator), ELSS (ELSS calculator), life insurance premiums, home loan principal, etc. (up to ₹1.5 lakhs).

- Section 80D: Health insurance premiums.

- Section 80CCD(1B): Contribution to NPS up to ₹50,000.

- Home Loan Interest (Self-occupied): Up to ₹2 lakhs under Section 24(b).

- HRA Exemption: If applicable, calculate using an HRA exemption calculator

- Standard Deduction: ₹50,000 (old regime) or ₹75,000 (new regime for FY 2024-25) for salaried individuals and pensioners. Our Standard deduction calculator can clarify this.

- Other deductions like 80G (donations), 80E (education loan interest), 80TTA/TTB (interest on savings).

- Choose Tax Regime: Select “Old Regime” or “New Regime” to see the calculation for each.

- Calculate: Click the calculate button.

Key Deductions to Remember for FY 2024-25 (Old Regime)

When using the income tax calculator and opting for the old regime, don’t forget these common deductions:

- Section 80C: Up to ₹1.5 lakh for specified investments and expenses. This includes contributions to EPF, PPF, life insurance, home loan principal, and a 5-year tax-saver

- Section 80CCD(1B): Additional ₹50,000 for contributions.

- Section 80D: For health insurance premiums (up to ₹25,000 for self/family, additional for parents, higher limits for senior citizens).

- Section 24(b): Interest on home loan (up to ₹2 lakh for self-occupied property).

- HRA Exemption: If you live on rent and receive a Housing Rental Assistance (HRA) benefit.

- Standard Deduction: ₹50,000 for salaried and pensioners.

Planning Your Taxes Beyond the Calculator

While an income tax calculator is a fantastic tool for computation, effective tax planning involves:

- Starting Early: Don’t wait until the last minute to make tax-saving investments.

- Aligning with Financial Goals: Choose tax-saving instruments that also help you achieve your long-term goals, like retirement or your child’s education.

- Understanding Your Options: Familiarise yourself with various tax-saving avenues.

- Maintaining Records: Keep all proof of investments and expenses readily available.

If your tax situation is complex, consider consulting a tax professional.

Conclusion: Empower Your Tax Filing with Confidence

Calculating your income tax for FY 2024-25 doesn’t have to be a daunting task. By leveraging an income tax calculator, you can gain clarity on your tax liability, compare tax regimes, and make informed decisions. This not only facilitates accurate tax filing but also supports better financial planning throughout the year. Ensure you use a calculator that is updated with the latest tax slabs and rules for AY 2025-26 to ensure precision.

Frequently Asked Questions (FAQs)

Which tax regime is the default for FY 2024-25 (AY 2025-26)?

The new tax regime is the default option for FY 2024-25. If you wish to opt for the old regime, you must make an explicit choice when filing your return.

What is the standard deduction for salaried individuals for FY 2024-25?

For FY 2024-25 (AY 2025-26), the standard deduction is ₹50,000 under the old tax regime and ₹75,000 under the new tax regime for salaried individuals and pensioners. You can verify this with our standard deduction calculator.

Can I switch between the old and new tax regimes every year?

Salaried individuals without business income can choose between the regimes each year. However, individuals with business income have limited options to switch back once they opt for the new regime.

How does an income tax calculator help in choosing between the old and new tax regimes?

Salaried individuals without business income can choose between the regimes each year. However, individuals with business income have limited options to switch back once they opt for the new regime.

Do I need to submit any documents when using an online income tax calculator?

No, you don’t need to submit documents to use the calculator. However, you will need accurate figures from your financial documents (such as salary slips, investment proofs, and bank statements) to obtain an accurate calculation.